In the individual / family health insurance market (i.e., coverage that people buy for themselves, as opposed to getting from an employer), open enrollment ended on January 15 in most states.

There are some state-run exchanges with different deadlines, although most of them are after January 15. Only Idaho opted to keep its open enrollment deadline in December.

As described below, Medicaid and CHIP enrollment are available year-round for eligible applicants, and American Indians and Alaskan Natives can also enroll year-round. And enrollment is available nationwide when people experience qualifying life events. But there are also some states where other types of coverage can be obtained outside of open enrollment:

Depending on your circumstances, your opportunities to enroll after the end of the annual open enrollment period may be limited. But you may find that you can still get coverage without having to wait for the next annual open enrollment period under certain circumstances.

Applicants who experience a qualifying life event gain access to a special enrollment period (SEP) to shop for plans in the exchange (or off-exchange, in most cases) with premium subsidies and cost-sharing reductions available in the exchange for eligible enrollees.

If you experience a qualifying life event, be prepared to provide proof of it when you enroll. And in most cases, the current rules limit SEP plan changes to plans at the same metal level the person already has. 1

The state-run exchanges (the ones that don’t use HealthCare.gov) can use their own discretion on this, but in general, if you’re enrolling outside of the annual open enrollment period, be prepared to provide proof of the qualifying life event that triggered your special enrollment period, and know that you might not be able to switch to a different metal plan (e.g., from Bronze to Gold or vice versa) during your SEP. And understand that in most – but not all – cases, the current SEP rules allow you to change your coverage but not necessarily go from being uninsured to insured (meaning that in most cases you won’t be eligible for a SEP if you didn’t have minimum essential coverage for at least one day out of the previous 60 days). So you may be asked to provide proof of your prior coverage in addition to proof of the qualifying life event.

And without a qualifying life event, major medical health insurance is not available outside of general open enrollment, on or off-exchange. This is very different from the pre-2014 individual health insurance market, where people could apply for coverage at any time. But of course, approval used to be contingent on health status, which is no longer the case.

American Indians and Alaska Natives can enroll in exchange plans year-round.

There is also a year-round enrollment opportunity for subsidy-eligible applicants whose household income doesn’t exceed 150% of the federal poverty level. (This is optional for state-run exchanges, although nearly all of them offer it.)

And people who qualify for Medicaid or CHIP can also enroll at any time. Income limits are fairly high for CHIP eligibility, so be sure you check your state’s eligibility limits before assuming that your kids wouldn’t be eligible – benefits do extend to middle-class households.

And in states where Medicaid has been expanded, a single individual earning up to $20,782 in 2024 can enroll in Medicaid based on the 2024 federal poverty level guidelines (the limit is higher in Alaska and Hawaii). Most states have expanded Medicaid, but there are still nine states where there is a Medicaid coverage gap and assistance is not available for most adults with income below the federal poverty level.

Similarly, if you’re on Medicaid and your income increases to a level that makes you ineligible for Medicaid, you’ll have an opportunity to switch to an individual plan at that point, with the loss of your Medicaid plan serving as the qualifying life event that triggers a special enrollment period.

For people who didn’t enroll in coverage during open enrollment, aren’t eligible for employer-sponsored coverage or Medicaid/CHIP, or don’t experience a qualifying life event, the options for coverage are limited to policies that are not regulated by the Affordable Care Act (ACA) and are thus not considered minimum essential coverage.

And most of these plans are designed to be supplemental coverage, rather than a person’s only health coverage. This includes things like limited-benefit plans, accident supplements, critical/specific-illness policies, dental/vision plans, and medical discount plans.

But there are a few types of coverage that are available year-round (generally only to fairly healthy individuals), and that can provide some coverage in a pinch while you wait for the next annual open enrollment period or a qualifying life event to enroll in a major medical plan:

In Kansas, Tennessee, Indiana, Iowa, South Dakota, and Texas, 2 members of Farm Bureau who are healthy enough to get through medical underwriting can enroll in Farm Bureau plans that are technically not considered insurance — and thus don’t have to comply with state or federal insurance regulations — but that are available for purchase year-round.

There are also health care sharing ministry plans available nearly everywhere, and although they are not subject to state or federal insurance laws, they are an option if you missed open enrollment and don’t qualify for a SEP, as they are available year-round to people who meet their eligibility criteria.

Some people choose to combine a health care sharing ministry plan with a direct primary care membership, although this is still not an ideal arrangement — direct primary care plans still need to be combined with ACA-compliant major medical plans in order to offer comprehensive coverage.

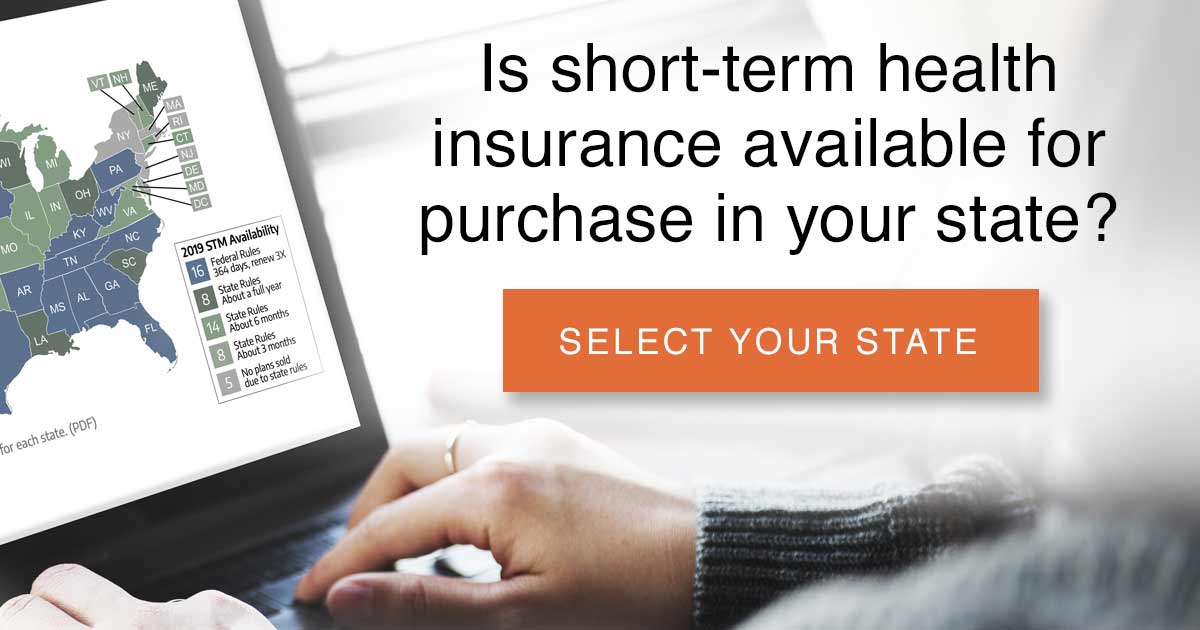

Short-term health insurance is available in most states. (DC and 14 states do not have short-term plans available.) It can provide some coverage if your other alternative is to remain uninsured. In most states, it’s an option if you find yourself needing to purchase a policy outside of open enrollment without a qualifying life event or aren’t otherwise able to obtain coverage outside of open enrollment as described above.

The Biden administration has finalized new rules for short-term health plans. Short-term plans issued or sold on or after September 1, 2024 will be limited to total durations of no more than four months, including renewals. However, prior to the new rules going into effect, the rules that took effect in October 2018 under the Trump administration still apply and implemented the following provisions:

States can still impose stricter rules than the federal guidelines, and over half the states do so. After the new rules take effect in September 2024, states will still be able to impose stricter rules, including prohibiting the sale of short-term health plans altogether..

If your income makes you eligible for the Obamacare (ACA) subsidies (including premium subsidies and/or cost-sharing reductions) and you want to take advantage of the subsidies, you’ll have to enroll through your state’s marketplace during open enrollment (or a special enrollment period triggered by a qualifying life event like losing access to your employer-sponsored health insurance). Otherwise, you’re missing out on the opportunity for comprehensive health insurance and the subsidies that are only available through the Marketplace. And premium subsidies are currently larger and available to more people as a result of the American Rescue Plan.

Some short-term plans have provider networks, but others may allow you to use any provider you choose (keep in mind, however, that you’ll likely be subject to balance billing if your plan doesn’t have a provider network, since the providers will not be bound by any contract with your insurer regarding the pricing for their services).

And short-term policies are not required to be renewable; federal rules allow insurers to offer renewable short-term plans, but does not require them to do so. Depending on your state’s regulations and your insurer’s business plan, you may be able to renew your short-term plans, or you may be able to purchase a new short-term policy when your existing one expires. But if you’re buying a new policy, the purchase will require new underwriting, and in most cases, the new policy will not cover pre-existing conditions, including any that began while you were covered under the previous short-term policy.

Unlike ACA-compliant plans, short-term policies have benefit maximums. But the concept of a “lifetime” limit is less significant when you’re talking about a plan that lasts for at most 36 months (the maximum amount of time a single plan can remain in effect under the current federal rules) or at most 4 months (the maximum amount of time a single plan can remain in effect under the federal rules for plans issued on or after September 1, 2024), since you likely won’t be able to purchase another short-term plan if you develop a serious health condition.

The application process is more simple for short-term policies than for individual health insurance. Once you select a plan, the online application is shorter, and coverage can be effective as early as the next day.

There are no income-related questions (since short-term policies are not eligible for any of the ACA’s premium subsidies), and the medical history section is generally short.

Although the medical history section generally only addresses the most serious medical conditions in order to determine whether or not the applicant is eligible for coverage, short-term plans generally have blanket disclaimers stating that no pre-existing conditions are covered.

And post-claims underwriting is common in short-term plans. 3 So although the insurer may accept your application based on what you disclose when you apply, they can – and likely will – carefully go back through your medical history if and when you have a significant claim. If they find anything indicating that the current claim might be related to a pre-existing condition, they can rescind your coverage or deny the claim. So although a short-term plan might work well to cover a broken leg, it’s going to be less useful if you end up with a health condition that tends to take a while to develop, as the insurer may determine that the condition, or something related to it, began before your coverage was in force. This story is a good example of how this works.

Short-term plans are not as comprehensive as the ACA-regulated policies that you can purchase during open enrollment or during a special enrollment period. Short-term insurance is not regulated by the ACA, so it doesn’t have to follow the ACA’s rules: The plans still have benefit maximums, and they are not required to cover the ten essential health benefits Most often, short-term plans don’t cover maternity, prescription drugs, preventive care, or mental health/addiction treatment 4 ), they do not have to limit out-of-pocket maximums, and they do not cover pre-existing conditions. They also still use medical underwriting, so coverage is not guaranteed-issue.

The majority of short-term plans do not cover outpatient prescriptions. Using a pharmacy discount card may lower medication costs without health insurance, and some discount prices may be lower than an insurance copay.

Although loss of existing minimum essential coverage is a qualifying event that triggers a special open enrollment period for ACA-compliant individual Marketplace plans, short-term policies are not considered minimum essential coverage, so the loss of short-term coverage is not a qualifying life event (loss of a short-term plan is a qualifying event for employer-sponsored coverage if you are eligible, however, so you’d be able to enroll in your employer’s plan when you short-term plan ends).

Let’s say you lose your job and your employer-sponsored health plan. You then have a 60-day window during which you can enroll in an ACA-compliant plan.

You also have the option to buy a short-term plan at that point, and it may be available with a term of up to a year, depending on where you live. (This will no longer be the case starting in September 2024). But when the short-term plan ends, you would no longer have access to an ACA-compliant plan (you’d have to wait until the next open enrollment, and a plan selected during open enrollment would become effective on no sooner than January 1).

And although you could purchase another short-term plan, your eligibility would depend on your current medical history. Some short-term plan insurers offer guaranteed renewability under the new federal rules, meaning that people can renew the plan, without going through medical underwriting, and keep it for up to 36 months. But not all insurers offer this option. (Again, these longer terms will not be available as of September 2024.)

Although short-term plans do not provide the level of coverage or consumer protections that ACA-compliant plans offer, obtaining a short-term policy is better than remaining uninsured. But the best option is to maintain coverage under an ACA-compliant policy; if you’re not enrolled, you’ll want to do so if you experience a qualifying life event.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.